LENDINGBLOCK: Borrow or Lend Easily Using the Platform Based on the blockchain technology

Introduction

Our life is filled with instances where we took help from friends. We borrow money from friends and family or banks in case of an emergency or otherwise. Another instance where this situation arises is our business. We need capital for business and for that, we require support from banking and financial institutions. The world of cryptocurrency has changed the spectrum of financial services. Cryptocurrency has become the most talked about currency in the world.

Governments and financial institutions have been working to find ways for mainstream adoption of the cryptocurrency and the technology behind it. Cryptocurrency has emerged as the latest currency in the market with large market capitalisation and user base. The complimentary services as available on the traditional market are still not offered in the cryptocurrency market. The range of financial services available on the cryptocurrency space is still limited. There is a need for the development of various real-life financial applications in the cryptocurrency so that people can enjoy the benefits of the digital currency.

Solution Offered

LENDINGBLOCK has come up with various cryptocurrency based services to create a transparent and efficient alternative financial space for the people. They are offering crypto assets lending services for the platform users. Borrowers of the digital assets have multiple opportunities on the platform. They have to follow the five-stage process on the platform before they can start borrowing. The process is same for the lenders on the platform.

One of the most important aspects of lending is the collateral. The process of collateralization on the platform is very specific and defined. The borrower has to maintain the appropriate level of collateral on the platform.

The functional components of the LENDINGBLOCK consist of six groups; user registration and maintenance services, order book management service, matching service, lending agreement initiation, lending maintenance and information maintenance.

For dispute resolution, they are thinking of creating a mechanism for it in the smart contracts. Liquidity is one of the most important things on the financial platform and they will focus on bringing more number of people to join their platform. Security, privacy, transparency and scalability are the core principles of the platform. The platform can be accessed in one of the three ways; direct, integrated and as a service through API. Their choice of creating a platform for crypto asset lending is based on the market requirement and growth potential of the cryptocurrency.

The matching engine perfectly matches the lenders and borrowers on the platform. Cross chain crypto to crypto lending opportunity is available on the LENDINGBLOCK platform.

ICO INFORMATION AND TEAM

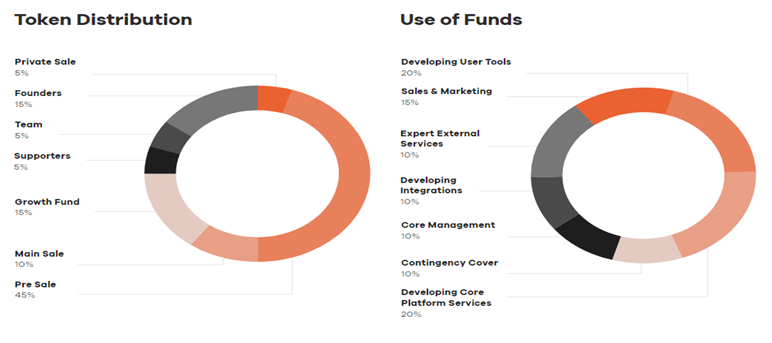

1,000,000,000 LND Tokens are created for the project in which 45% is reserved for the pre-sale. Token presale will start from 7th April 2018 and continue until 14th April 2018. 10% of the total tokens are reserved for the main sale. The main sale of tokens will start from 15th April 2018 and continue until 22nd April 2018.

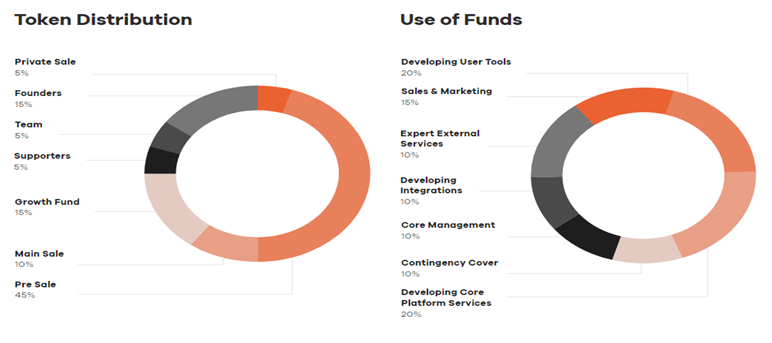

20% of the funds will be used for the development of user's tools while 15% of the total funds will be spent on the marketing. The team has experience and rich background in investment banking, finance and blockchain technology.

20% of the funds will be used for the development of user's tools while 15% of the total funds will be spent on the marketing. The team has experience and rich background in investment banking, finance and blockchain technology.

Conclusion

One aspect of business operation is the raising the capital and it does not matter whether you are a startup or a matured corporate house, you require loans for your company. The traditional source of borrowing money is the bank where people and businesses can borrow money for their use. Margin lending, credit score lending, crypto to fiat lending are a few of the current lending opportunities in the cryptocurrency space.

The cryptocurrency market is still in its early stage and as the market matures, we will see many different financial products in the market. The main aim of the users and companies should be increased use of the cryptocurrency in daily life.

The market needs applications such as offered by LENDINGBLOCK to attract more people in the cryptocurrency. What happens after the introduction of the platform is not known but people will be happy to find a platform, which serves their need in the cryptocurrency world. Are you ready to borrow or lend?

Twitter:https://twitter.com/lendingblock

Telegram:http://t.me/lendingblock

Published By:Kishan748

Btalk Profile:https://bitcointalk.org/index.php?action=profile;u=1027561

Btalk Profile:https://bitcointalk.org/index.php?action=profile;u=1027561

Comments

Post a Comment