CROWDGENIE: Borrowing from people by the people is the motto of the Platform

You get an idea to build a space elevator but what else do you need other than a mere idea? Useful resources and a perfect team which believes in the vision and the motives of the company. You have all the resources but eventually, you could not the create the product you wanted to. And, now you decide to create another one but you need more credit which requires lending from big capital ventures and banks, so what do you do? You have to agree on something to get something and the deal is done. The lending is the biggest opportunity for investors to create a perfect investment bet based on the multiple factors, which involve the quality of the idea and the team working on the project.

We all are aware of the lending in our life. The loans we took off to pay our student debts and cars and homes. Build for people who can choose to share their dream with others and get support in the variety of form offered. But, the situation is not same for everyone as we know that in many parts of the world, traditional financing system has become ineffective resulting in the lack of funds for the SMEs and loss of real ideas. People have been working against the traditional and centralised system to replace it with the open and transparent mechanism of financing an idea. What is the solution?

CROWDGENIE

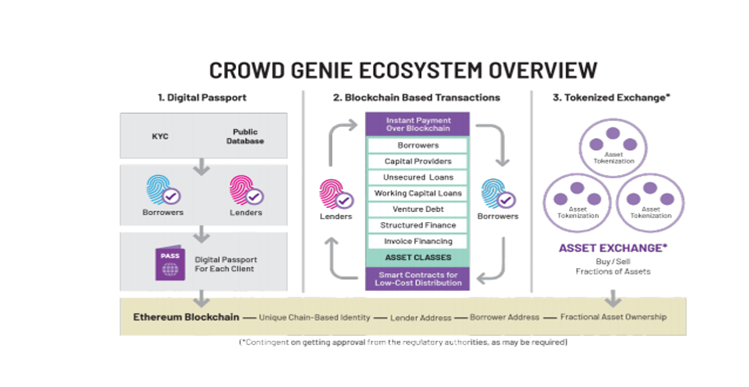

A financial firm registered in Singapore is ready with a ring-fenced fund managed by escrow agents. The funds are available for lending purposes. It is a marketplace for people who can take the loan from people without the need of any intermediary. There are many advantages of the platform which is already making waves in south-east Asia. A FEW OF the features of the platform is mentioned below.

- The credit rating of the platform is backed by artificial intelligence which determines the capability of the borrowers.

- Directors of the platform to invest in the project other than people

- Regulated Escrow agent outside of the platform

- Operational company generating cash flow

- Meets the technical and regulatory requirements of Singapore

The platform is a p2p lending marketplace where security of the funds invested is guaranteed by the CROWD GENIE by creating a special fund called GENIE Fund. They have tried to bring change in the centralised lending marketplace and as long as people are repaying what they are borrowing, we can hope for the best.

CGC Token Sale

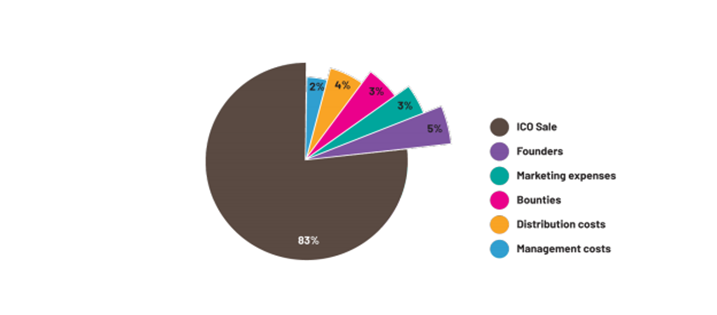

120,000,000 CGC Tokens are created for the project in which 50,000,000 tokens are reserved for the ICO. One ETH is equal to 400 CGC. Crowdsale is currently live on the platform and continues until tomorrow.

People investing in the platform are offered the bonus tokens depending on the time and quantity of the investment. The team has been running this platform for over 18 months and they are determined to achieve the impossible in the P2P lending.

People investing in the platform are offered the bonus tokens depending on the time and quantity of the investment. The team has been running this platform for over 18 months and they are determined to achieve the impossible in the P2P lending.

Conclusion

Getting resources at the time of the emergency is the perfect solution to save lives of the people and corporations. The removal of the intermediary between people will be the biggest achievement of the platform, and this can be done as it is evident from the operation of the platform for over 18 months. The P2P lending will be the future of the lending and borrowing money. Providing security to the investors as they put their money into the platform will be the key priority of the team.

They have managed to build an exceptional platform and what needs to be done now is the expansion of the project in other Asian Countries. So, what do you think about the success of the platform in other Asian countries? I think they will be successful in other places too, as people require trust and transparency in the lending marketplace. Are you ready to borrow from the platform?

To know more visit:

Website : https://www.genieico.net/

Published By: Kishan748

Btalk Profile : https://bitcointalk.org/index.php?action=profile;u=1027561

Comments

Post a Comment